How does a Cordillera Minerals Flow-Through Limited Partnership Work?

- Investors purchase units of the Cordillera Minerals Flow-Through Limited Partnership and the net proceeds are used by the limited partnership to purchase the flow-through shares of Canadian Mineral Resource Issuers (junior exploration mining companies).

- The resource companies renounce their CEE rights to the limited partnership, which then allocates the CEE to its investors.

- The investors can then deduct the CEE against their income. The adjusted cost base of the flow-through units (ACB) is reduced by the tax deductions to zero, and increased by any capital gains when the investments are sold.

- At liquidity, the Cordillera Minerals Flow-Through Limited Partnership unitholders will DIRECTLY receive their pro-rata shares of a portfolio of select Mineral Issuers through an electronic distribution. This allows the Investor and their financial advisor to determine when they would like to choose to sell or if they will continue to hold the Mineral Issuer shares for potential appreciation in the years to come.

- There is no immediate tax liability until the investor decides to sell their shares, which allows investors the option to defer their tax liability or to do additional tax planning such as contributing the portfolio of Mineral Issuer shares into their RRSP for an additional tax deduction in the year following their initial investment*

*There is capital gains payable on any deemed disposition of the Mineral Issuer shares including selling or contributing the shares into an RRSP.

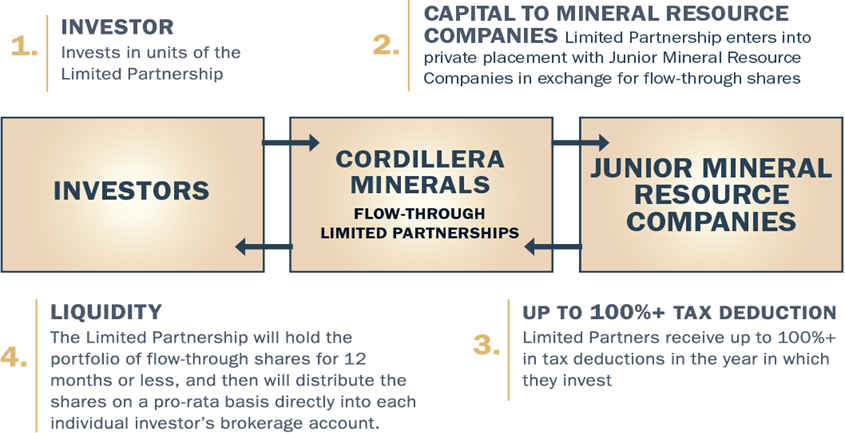

The diagram below illustrates the lifecycle of an investment in the Limited Partnership and the relationship among investors and the resource companies in which the funds invest.

Investors purchase Units in a Cordillera Minerals Flow Through Limited Partnership which is a tax-advantaged Limited Partnership whose mandate is to provide capital appreciation through a diversified portfolio of resource stocks. Investors also benefit through the realization of tax savings of up to 100%+ of the amount invested. The tax savings are applicable to income from employment, business or property. Through investing in a flow through Limited Partnership, investors are able to defer the payment of tax on income until sometime in the future – when the flow through shares are liquidated, transferred or contributed into an RRSP – at which time the sale proceeds will be taxable in the hands of investors at the more favorable capital gains tax rate.